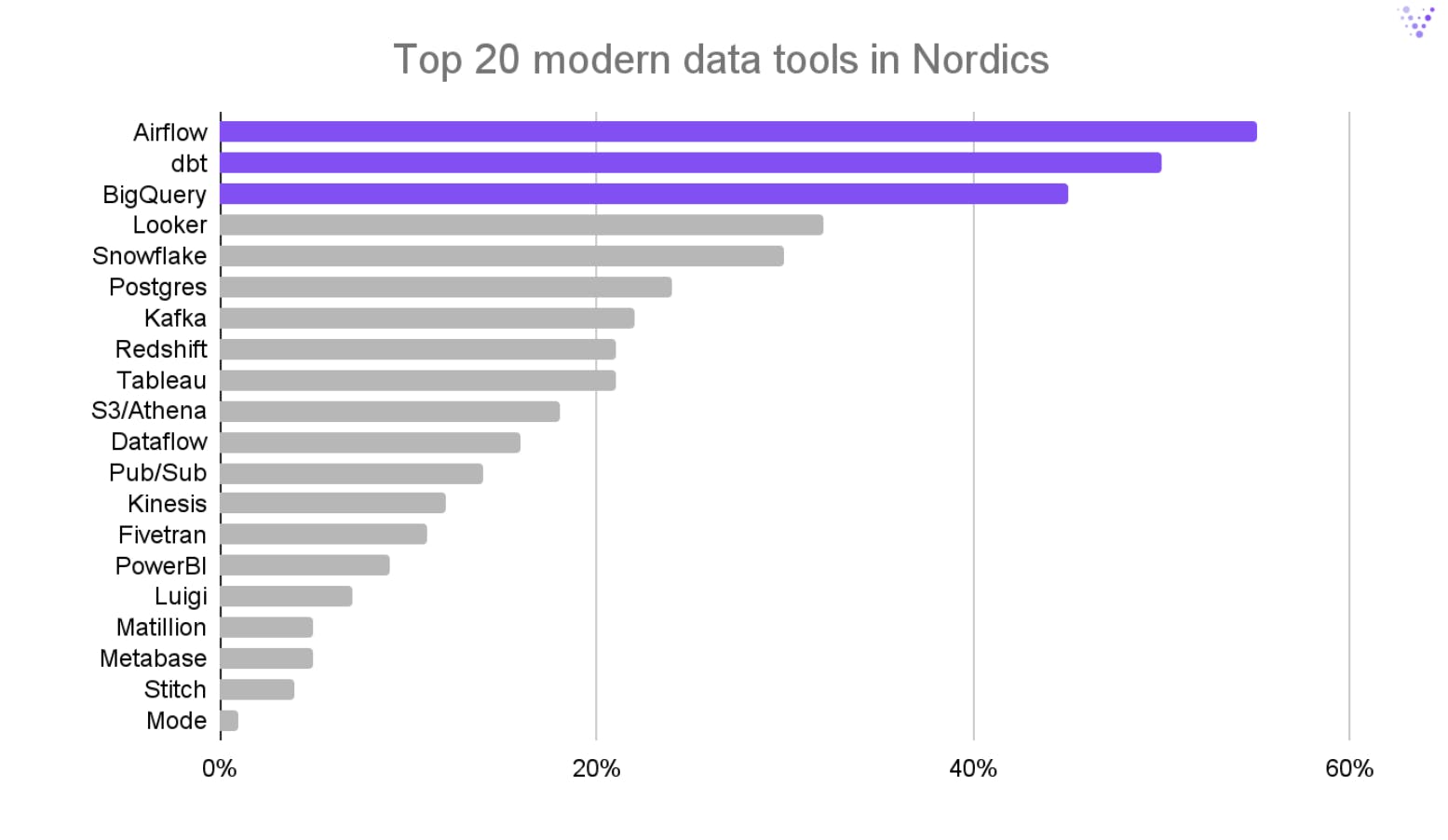

The 20 most popular data engineering tools in the Nordics

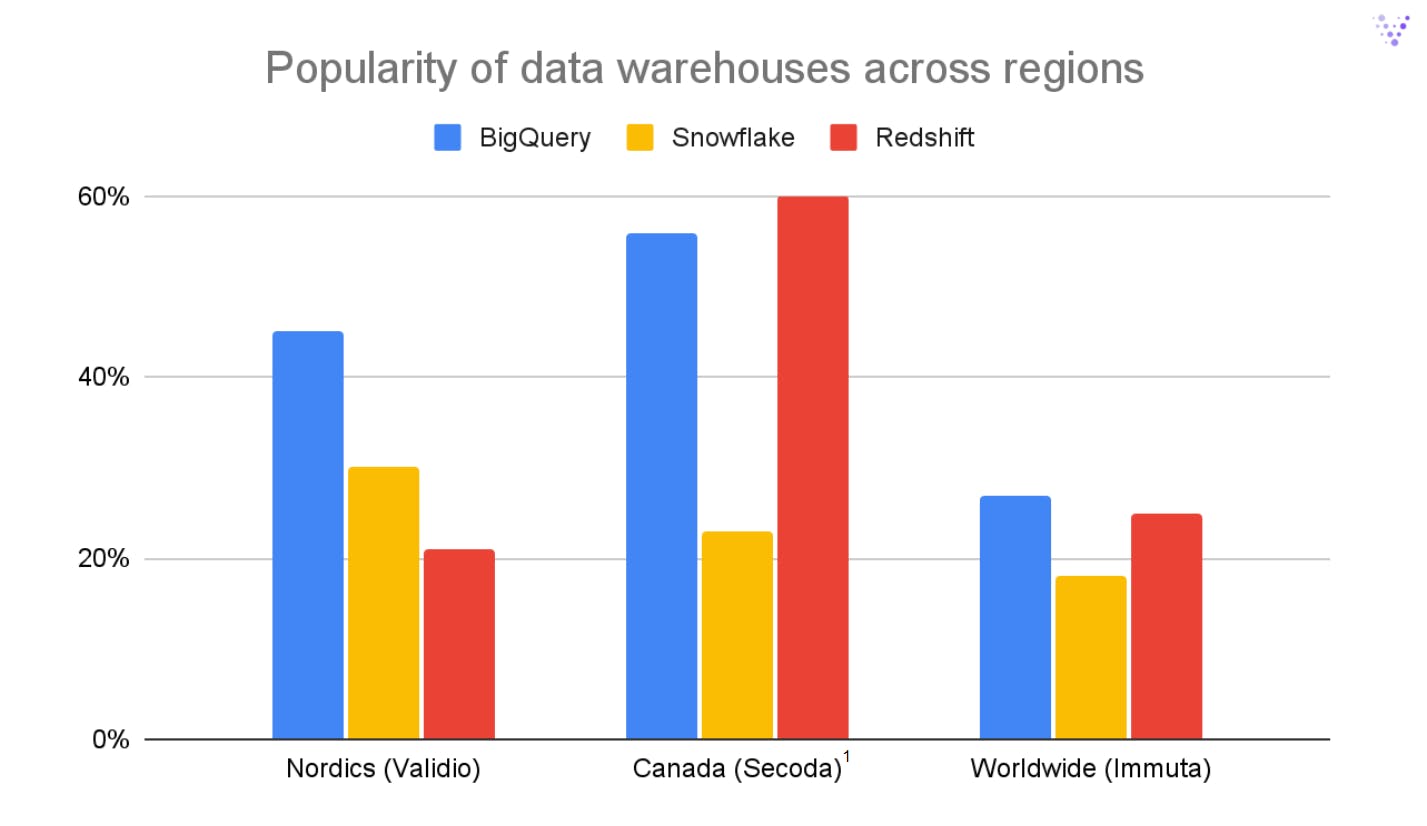

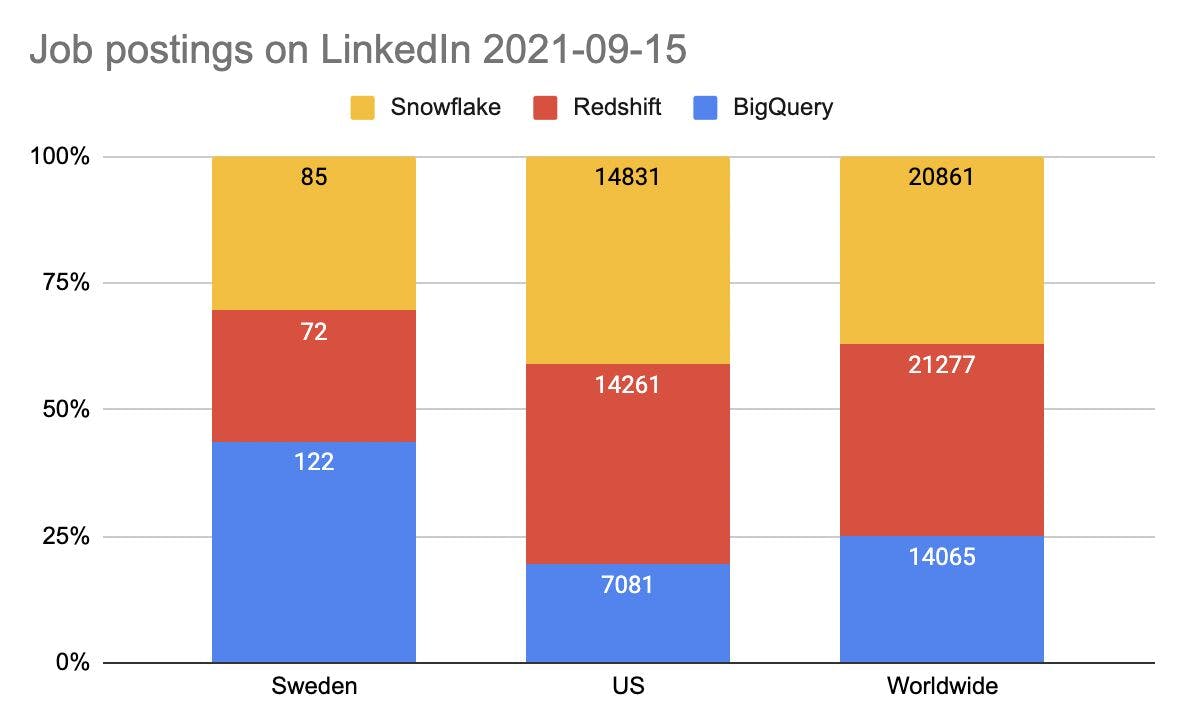

And the surprising role of BigQuery

At Validio, we’ve had the pleasure to speak with 100+ modern data teams globally, many of them located in the Nordics. During our conversations, we’ve covered topics such as the requirements needed for data pipelines, rationale for technology choices and the challenges involved when building out the data infrastructure. One specific topic we’ve covered extensively includes the technology preferences and tools being used by data teams in their data stacks. We’ve taken a look at our notes, crunched some data, and now share our findings on the 20 most popular data engineering tools being used in the Nordics.

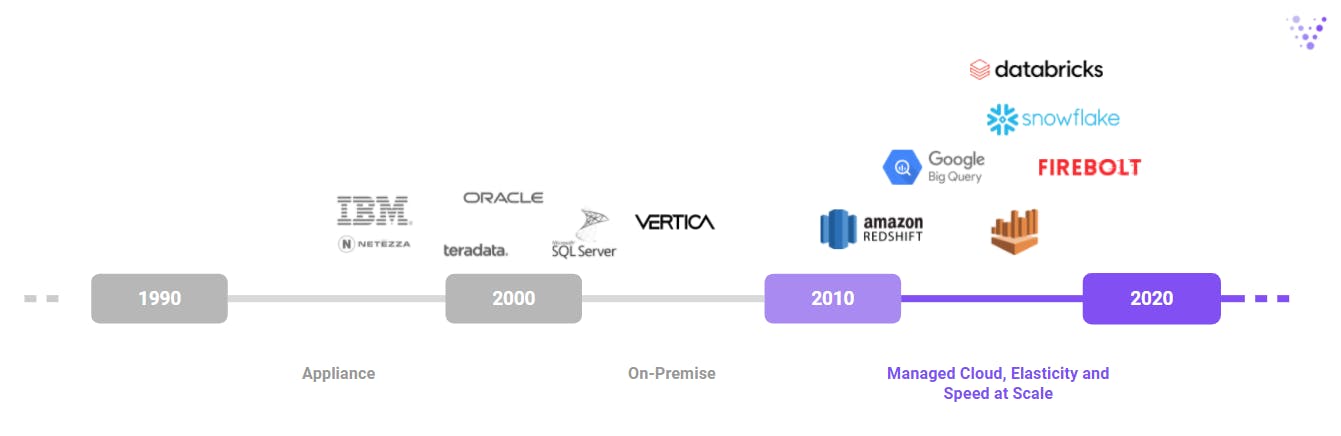

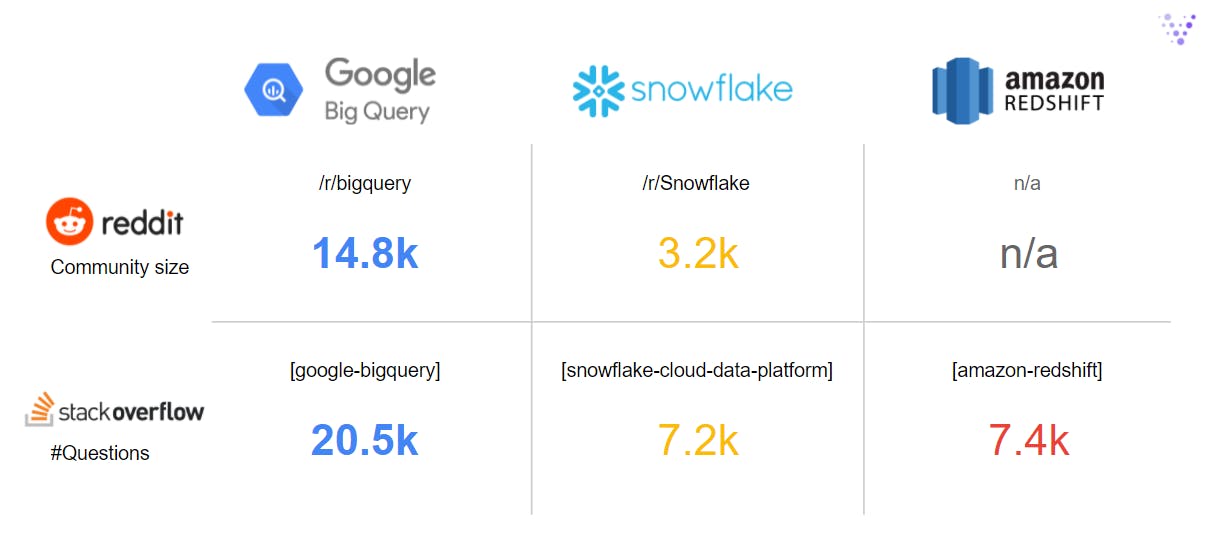

In addition, we’ll do a deep dive on the adoption of cloud data warehouses in the Nordic region. As noted by Matt Turck in the 2021 Machine Learning, AI and Data Landscape analysis, modern cloud data warehouses have unlocked an entire ecosystem of tools and companies:

“Today, cloud data warehouses (Snowflake, Amazon Redshift and Google BigQuery) and lakehouses (Databricks) provide the ability to store massive amounts of data in a way that’s useful, not completely cost-prohibitive and doesn’t require an army of very technical people to maintain. In other words, after all these years, it is now finally possible to store and process Big Data. That is a big deal, and has proven to be a major unlock for the rest of the data/AI space." - Matt Turck, Partner at FirstMark Capital

The companies we’ve spoken with are primarily fast-growing scaleups and unicorns; hence a majority of the data teams we’ve spoken to have been able to build greenfield data stacks, without being entrenched in legacy on-prem systems needing migrations or retrofit integrations. In light of that, don’t be surprised if you don’t see tools such as Oracle database or Microsoft SQL Server on the list.

Let’s dig in!

Airflow, dbt and BigQuery (?) topping the list

Perhaps the most interesting thing about modern data tool usage in the Nordics is the prevalent usage of Airflow, dbt and BigQuery—all of which are being used by almost half of the teams we’ve spoken to.