Full compliance and data trust for financial services

Ensure compliance, precise reporting, and accurate decisions based on data you can trust. For better return on data- and financial investments.

Banking

Improving risk management and regulatory compliance with better data control.

Asset management

Increase the trust in data and ensure accuracy and completeness in reporting.

Fraud detection

Safeguarding performance of AI models for credit scores and fraud detection.

Data quality can turn into capital advantage

>€250 m

saved

from reduced capital add-ons

10x

faster

regulatory compliance

>€50 m

saved

from operational efficiency gains

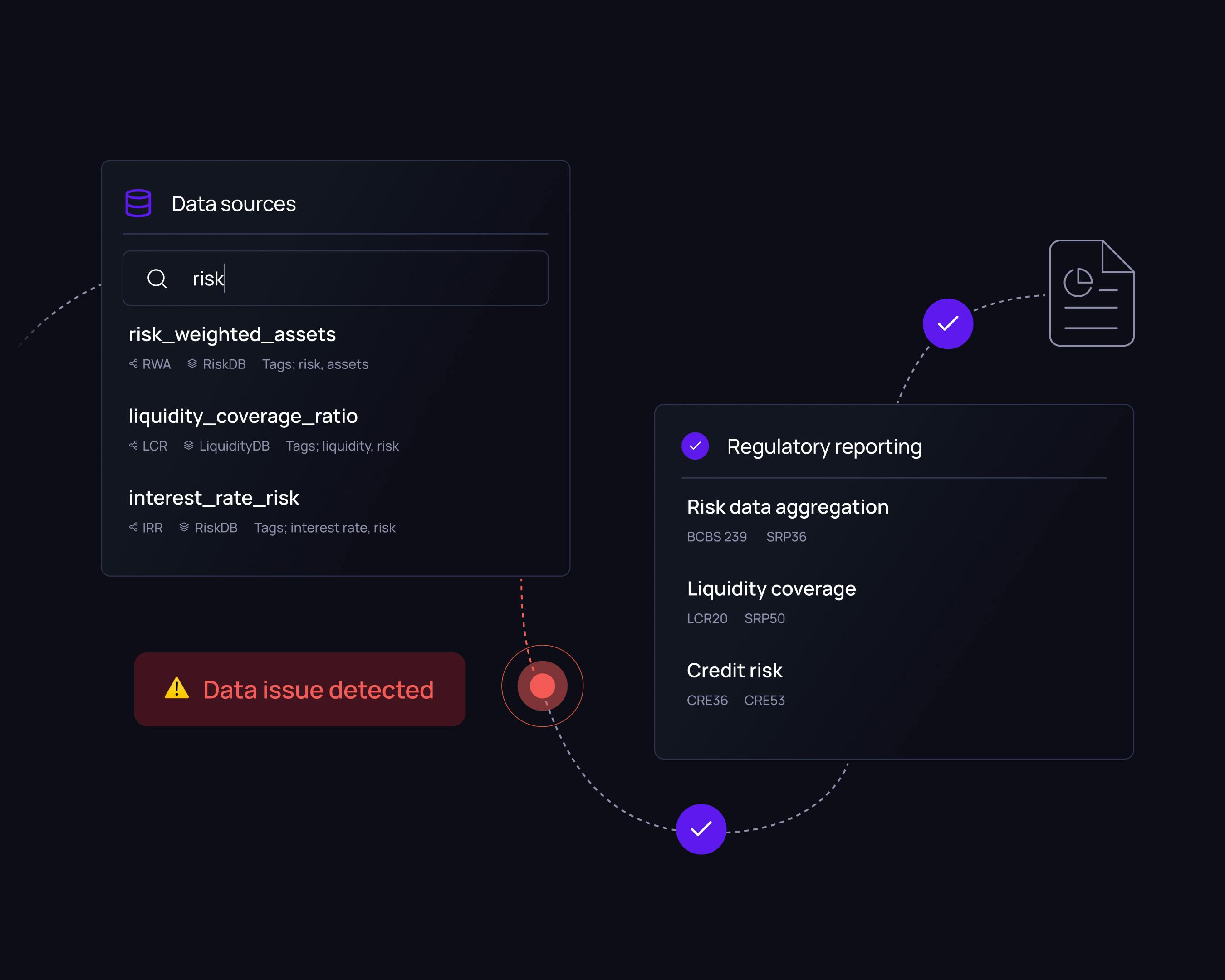

Monitoring from data to report

Built to speed up regulatory compliance

Regulatory frameworks like Basel framework makes high-quality risk data non-negotiable. Validio ensures compliance with standards like BCBS 239, IRB, and LCR by embedding accuracy, completeness, timeliness, and lineage at the core of your data operations.

BCBS 239 makes

data quality non-negotiable

Governance made easy

End-to-end lineage for audit readiness

Validio continuously monitors your data pipelines, from source to report. With real-time anomaly detection, audit trails, and automated validation, you’ll always know if your regulatory reports are correct, or why they’re not.

"Trust of data is very critical. so the one thing we want to do is always try to find issues within the data before the business even sees it, and Validio has definitely pushed us to the forefront of being able to achieve that goal."

Albert Obeng

Head of Technology

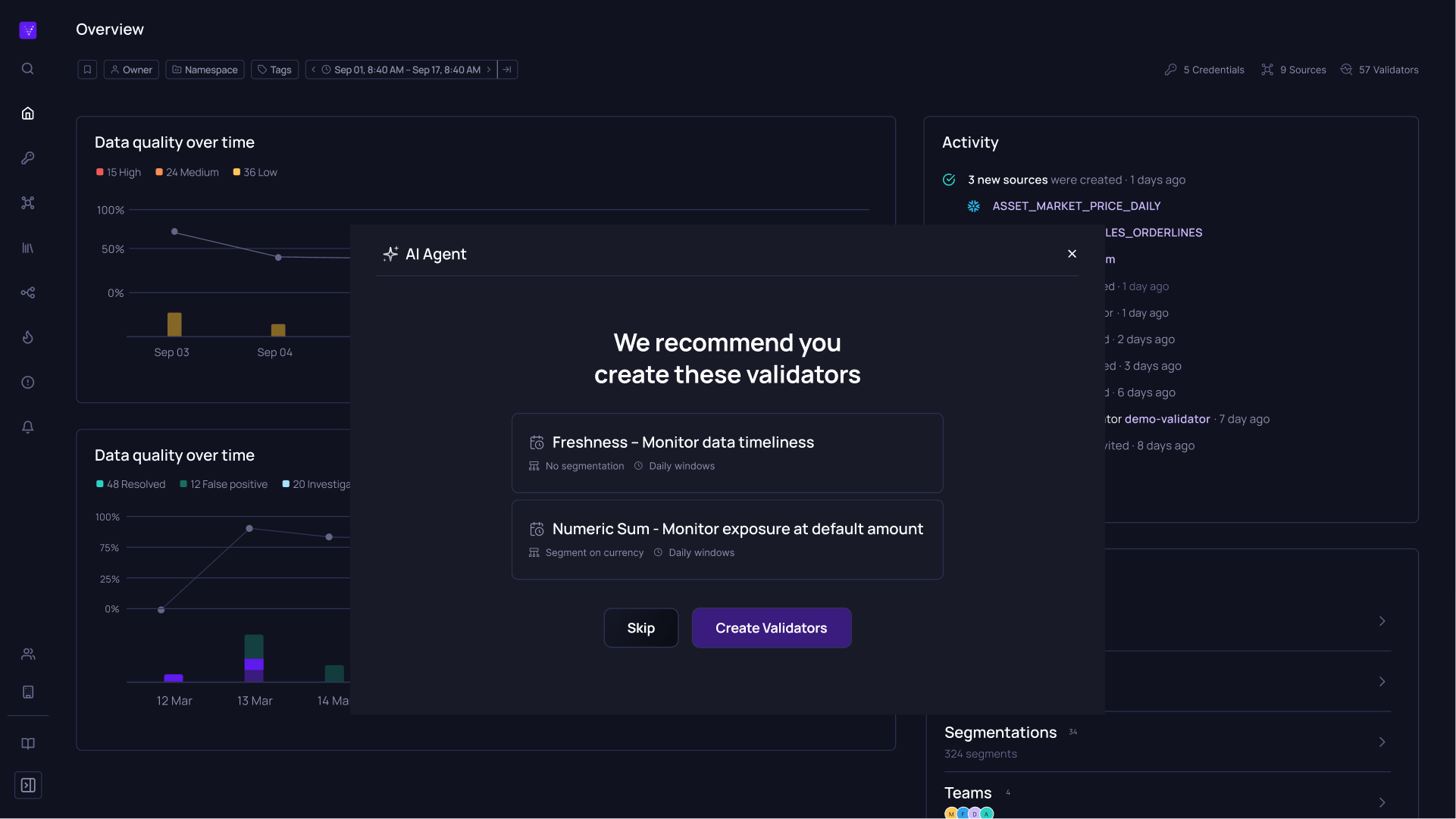

AI-powered automation

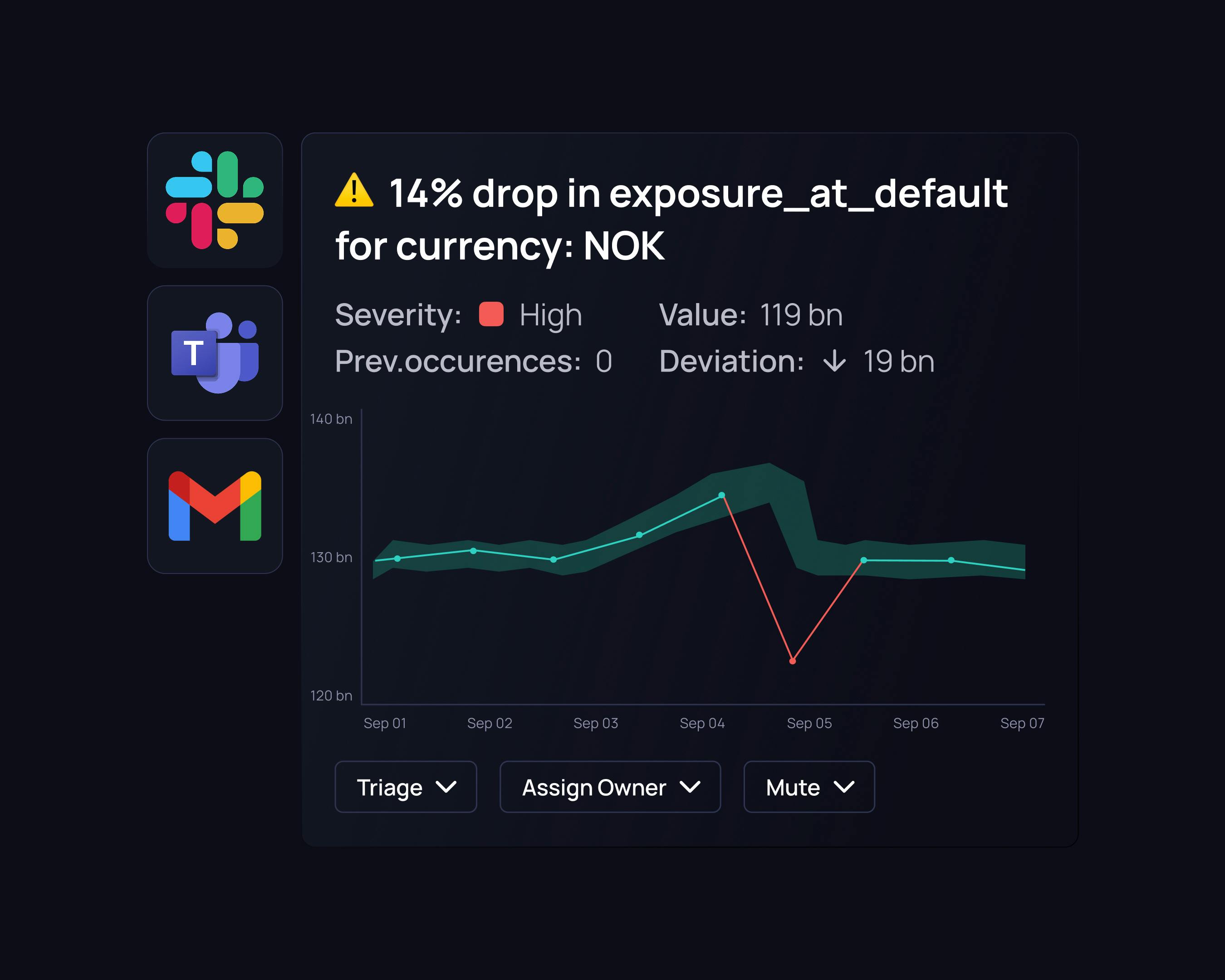

Automated anomaly detection drives efficiency

The out-of-the-box AI detects data issues within minutes, instead of weeks or months. Instant alerts and automated root-cause analysis cut manual data quality work by up to 95%, freeing your team to focus on value-driving tasks

Time to simplify compliance and bring trust to your data?