[Stockholm, 2024-08-23]

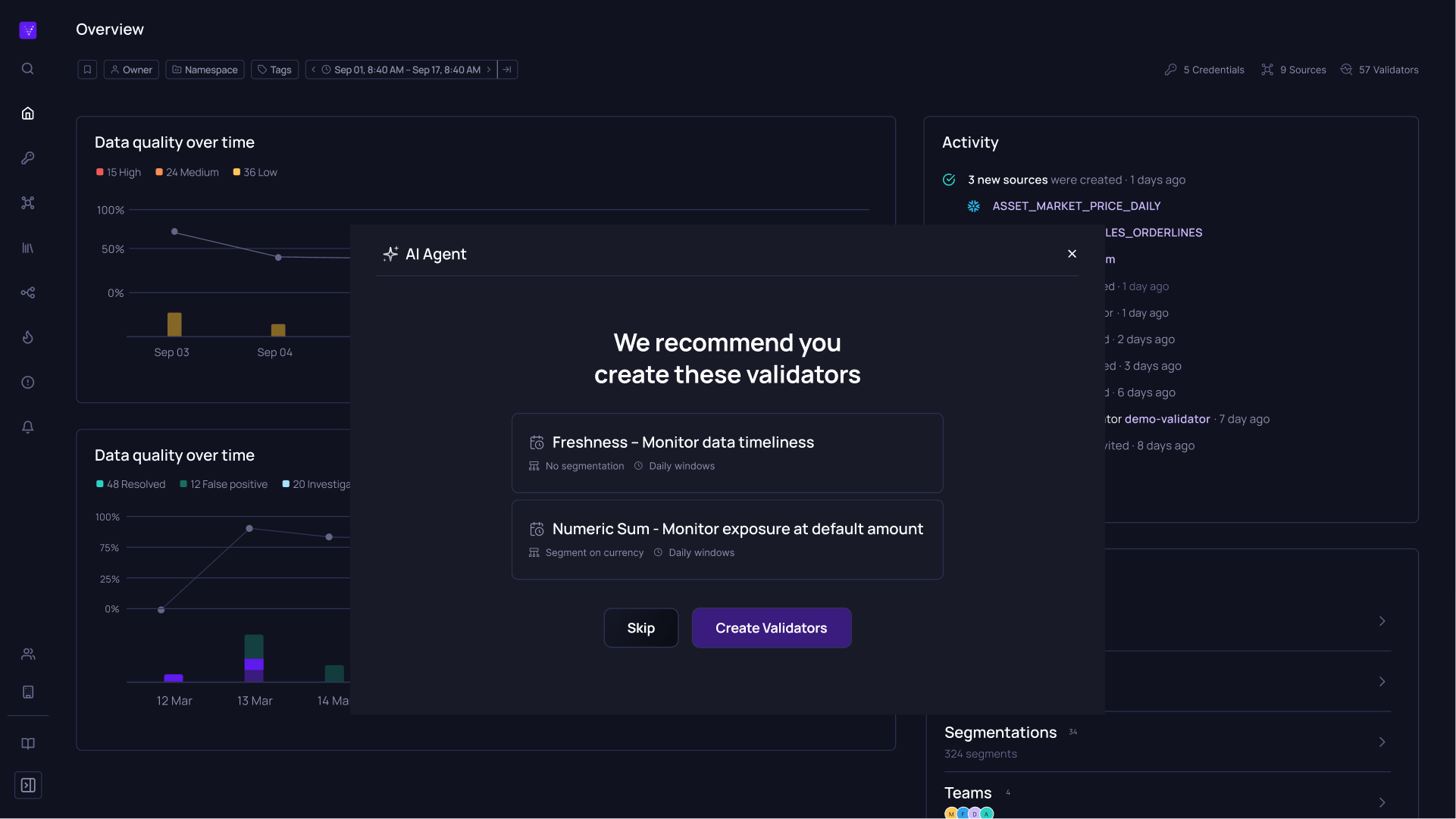

Volt, a pioneering real-time payments company, is partnering with Validio, the leading data trust platform. The collaboration focuses on further strengthening the resilience of Volt's global payment network, minimizing the risk of downtime and ensuring continuous, uninterrupted payment experiences for merchants and consumers globally.

For Volt’s global real-time payment network it is crucial to monitor deviations in key metrics such as traffic and payment volume, payment initiation and conversion, and clearing times. With Validio’s automated business monitoring, Volt can proactively catch and fix hard-to-detect operational issues. This enables a belt and braces approach to ensuring seamless operation, reduced down time and frictionless payments for their merchants.