[Stockholm, 2023-08-31]

Company information

About AB CarVal

AB CarVal is an established global alternative investment manager and part of AllianceBernstein's Private Alternatives business. Since 1987, AB CarVal's team has navigated through ever-changing credit market cycles, opportunistically investing $147 billion in 5,730 transactions across 82 countries. Today, AB CarVal has approximately $16 billion in assets under management in corporate securities, loan portfolios, structured credit and hard assets.

Industry

Asset management

Datastack

“We are really excited about Validio. As we process data & bring it in with dbt [...] we want to be able to detect anomalies in the data that we've stored in Snowflake. Based on the metrics we care about, we create alerts in Validio, and if there's a spike or anomaly in the data set we know it right away.“

Albert Obeng, Director of Technology at AB CarVal

AB CarVal aimed to enhance its processes and tools to support scaling operations and grow its Assets Under Management. Their strategy focused on bolstering data trust by improving data quality and ensuring proactive communication in the event of data incidents. Additionally, they sought to strengthen data ownership by providing clear catalog and lineage oversight while empowering non-technical staff with the ability to self-serve and access data efficiently.

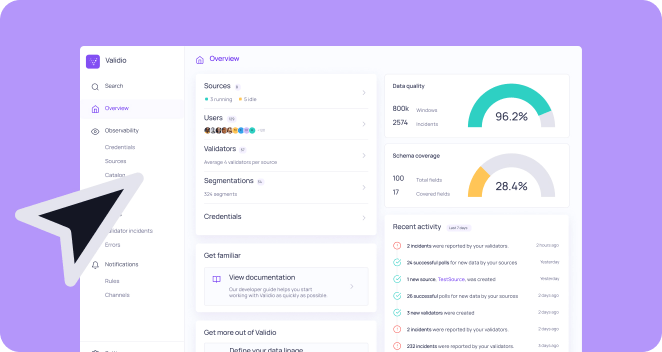

AB CarVal elevates data quality with Validio's AI-powered Data Trust Platform

Earlier this year, AB CarVal adopted Validio’s AI-powered Data Trust Platform, giving them complete oversight of their data, with a robust data trust workflow that enables stakeholders to collaborate and swiftly resolve data incidents.

“We have Validio looking across all our datasets. We put alerts on the metrics we care most about, and if there at some point is a spike in a metric, we will know about it.”

Albert Obeng, Director of Technology at AB CarVal

Validio’s Data Trust Platform unifies data quality, observability, lineage, and catalog—giving AB CarVal one interface to achieve everything they need to establish full trust in their most business-critical data. With Validio’s all-in-one offering, AB CarVal’s teams can efficiently collaborate on catching and resolving data issues before they impact key business metrics.

Albert continues:

“We utilize Validio for data quality, lineage, and cataloging. It complements our data stack to give us the observability we need.”

Prioritizing and optimizing data assets with Validio

On top of having guardrails to prevent issues from reaching the business, anyone in the organization can use Validio’s Data Catalog to easily discover the data they need, and use the Data Asset Insights to understand how it’s utilized. Highly utilized assets can be prioritized with advanced monitoring, while underutilized assets can be considered moving to cold storage for cost-saving purposes.

“It’s a privilege to work with the talented team at AB CarVal. I’m excited to drive business impact with them and see what they can achieve with Validio’s platform.”

Patrik Liu Tran, CEO and Co-founder of Validio

AB CarVal and Validio sets new standards for data excellence

AB CarVal's adoption of Validio's Data Trust Platform marks a substantial step in enhancing the way investment management firms approach data quality and trust. This partnership illustrates a shared dedication to ensuring that data integrity is at the core of every major decision, potentially paving the way for new industry practices. Looking ahead, we anticipate the partnership will yield valuable insights and opportunities that benefit both AB CarVal and the broader field. AB CarVal's investment in data quality, backed by Validio's technology, is poised to contribute to more informed, data-driven decision-making within the realm of investment management—shaping a more dependable and efficient future for those who rely on accurate data to guide their strategies.

About AB CarVal

AB CarVal is an established global alternative investment manager and part of AllianceBernstein's Private Alternatives business. Since 1987, AB CarVal's team has navigated through ever-changing credit market cycles, opportunistically investing $147 billion in 5,730 transactions across 82 countries. Today, AB CarVal has approximately $16 billion in assets under management in corporate securities, loan portfolios, structured credit and hard assets.

About Validio

Validio is a Stockholm-based Data Trust company that gives customers full trust in their data, by going beyond mere monitoring to unify data observability, quality, lineage, and cataloging. Validio’s Data Trust Platform provides a holistic view of your data ecosystem, letting data teams and business stakeholders collaborate effortlessly to resolve issues quickly and improve your business metrics. We’re proud to be the trusted partner of leading Companies like Truecaller, OfferFit, AB CarVal, and Voi, who leverage our platform to get 100% trust in their data and use it to achieve real-world results.

Want to try it out?