As fintechs rapidly evolve, the complexity of payment ecosystems makes it challenging for companies to uphold seamless payment services. The intricate interplay between banks, merchants, customers, and diverse payment methods across various markets complicates the task of protecting critical business metrics like service uptime and conversion rate.

Additionally, battling fraud and following strict data regulations further increase the difficulty and importance of ensuring the financial integrity of your business.

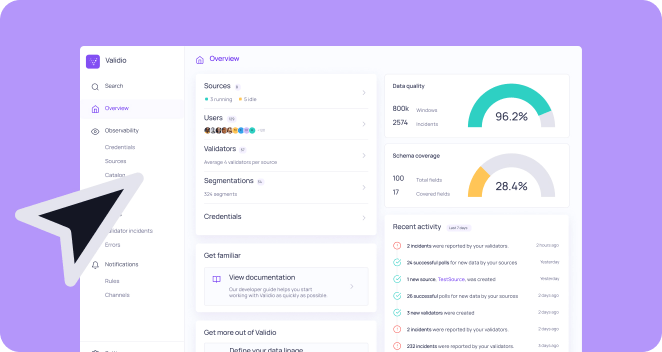

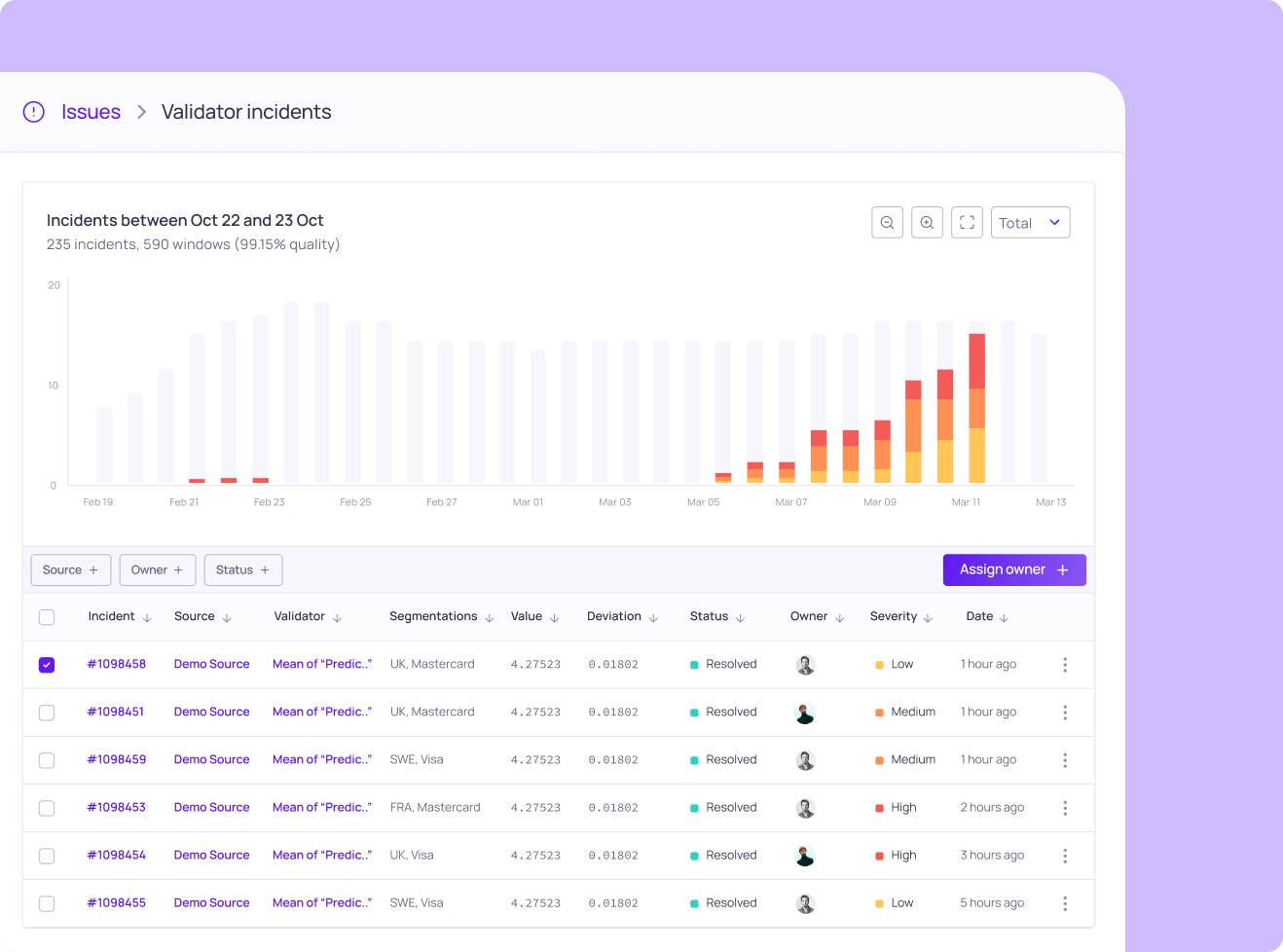

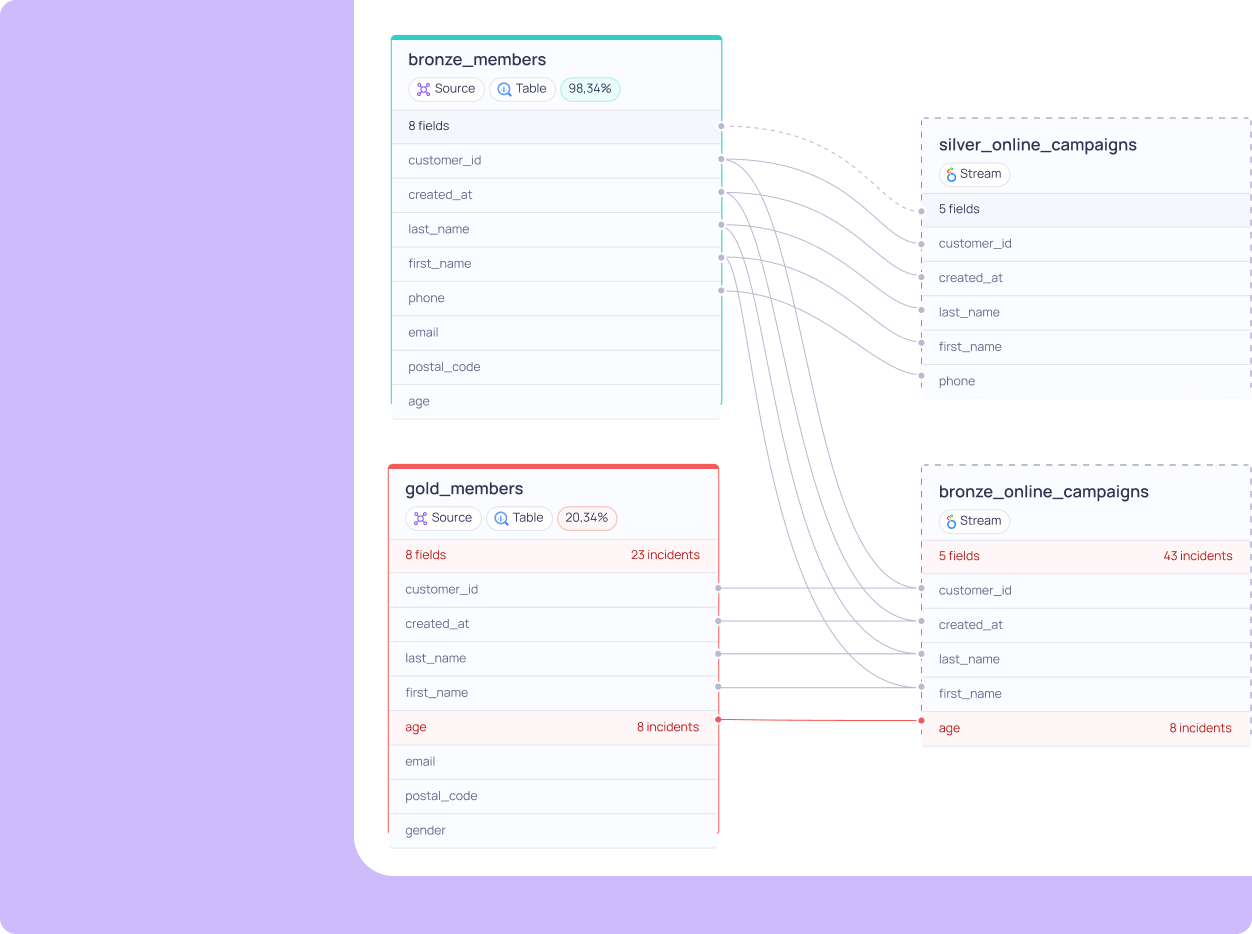

This blog post will explore four ways Validio's AI-powered anomaly detection can uncover sneaky issues lurking deep in your data segments, helping your business maintain uninterrupted payment services and satisfied customers.

TABLE OF CONTENTS